Alliant provides some of the most competitive interchange rates in the industry..

Three Cost Factors Associated With Processing

-

Interchange refers to fees paid by the merchant’s bank to the issuing bank for this service. Interchange covers the cost to convert a charge on an account holder’s card to a cash deposit at the merchant’s bank account, including billing services, credit risk, fraud risk, and float.

-

These are fees are paid directly to the card associations to cover operating costs of managing their networks

-

Fees charged by the payment processor to accept authorization on transactions, reporting, and settlement.

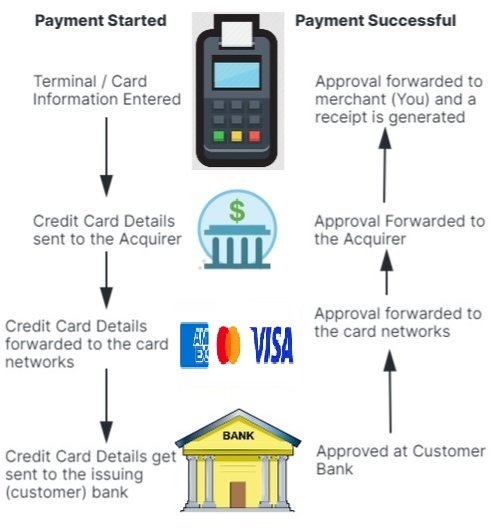

Understanding Merchant Services/ Processing

What is my biggest expense when processing payments?

Interchange is the single largest expense for card processing. For most merchants, it represents 70 to 85 percent of the total cost of processing. Interchange is the price charged by the card networks (Visa, MasterCard, Discover, American Express) for processing a transaction.

What determines Interchange for a Transaction?

Interchange is determined for each transaction based on the industry of the merchant, the type of card, the way the card is accepted, and the transaction size.

How can I keep my processing costs low?

Alliant can help set you up with the proper way to process to keep your costs low. This would include the following:

Have an up to date terminal that accepts EMV as well as other processing methods

Chip Read/Swipe Cards when possible

If you have to manually enter, have a gateway that can process Level 2, Level3, etc.. to optimize your transaction and get you the best possible rate.

What are interchange fees?

Interchange is the fees charged by the card brands and issuing banks to cover the “cost” of money to give you the short-term loan (credit card purchase), rewards programs, and internal costs (including fraud).

What could increase my interchange cost? Some examples are:

Manually entering the transaction drives up the cost

Rewards Cards have higher interchange costs

Commercial (Business) Cards have higher interchange rates

How hard is it to get started?

Not hard at all! Alliant can walk you through an application and within 24-48 hours your account is approved. At that point, we would help you decide the best way to process and you could be processing within 48 hours or less!